All Categories

Featured

Table of Contents

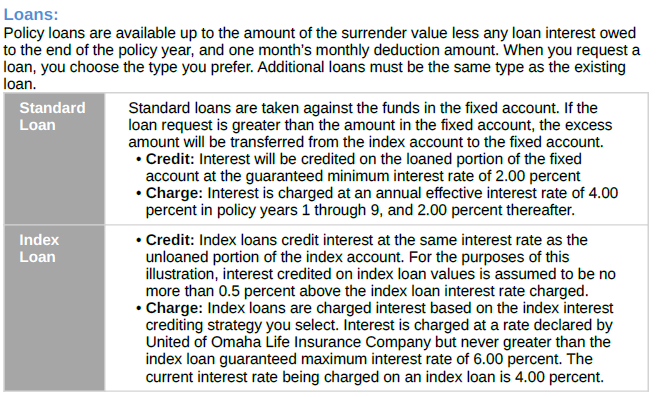

The price is established by the insurer and can be anywhere from 25% to more than 100%. (The insurer can also transform the get involved price over the life time of the policy.) As an example, if the gain is 6%, the involvement rate is 50%, and the present cash money worth total is $10,000, $300 is contributed to the money value (6% x 50% x $10,000 = $300).

There are a number of benefits and drawbacks to consider prior to buying an IUL policy.: Just like common global life insurance coverage, the insurance policy holder can boost their premiums or reduced them in times of hardship.: Amounts attributed to the cash worth grow tax-deferred. The cash worth can pay the insurance premiums, permitting the policyholder to reduce or quit making out-of-pocket premium settlements.

Numerous IUL policies have a later maturity day than other sorts of universal life policies, with some finishing when the insured reaches age 121 or even more. If the insured is still to life back then, plans pay out the survivor benefit (but not usually the cash value) and the earnings may be taxable.

: Smaller sized policy face values do not provide much advantage over routine UL insurance policy policies.: If the index goes down, no interest is credited to the cash worth. (Some policies supply a reduced guaranteed rate over a longer period.) Other financial investment cars use market indexes as a benchmark for performance.

With IUL, the goal is to benefit from upward motions in the index.: Because the insurance provider just gets options in an index, you're not directly purchased supplies, so you don't profit when firms pay rewards to shareholders.: Insurers cost fees for managing your money, which can drain money worth.

Universal Guarantee Life Insurance

For lots of people, no, IUL isn't better than a 401(k) in terms of conserving for retired life. Many IULs are best for high-net-worth individuals searching for means to minimize their taxed earnings or those that have actually maxed out their other retired life choices. For everyone else, a 401(k) is a much better investment automobile because it does not lug the high charges and premiums of an IUL, plus there is no cap on the quantity you may make (unlike with an IUL policy).

, the profits on your IUL will certainly not be as high as a normal investment account. The high expense of costs and fees makes IULs pricey and substantially much less budget-friendly than term life.

Indexed universal life (IUL) insurance policy provides cash money value plus a survivor benefit. The cash in the cash money worth account can make rate of interest with tracking an equity index, and with some often allocated to a fixed-rate account. Nonetheless, Indexed universal life policies cap how much cash you can build up (typically at much less than 100%) and they are based upon a perhaps unpredictable equity index.

Index Universal Life Insurance Quotes

A 401(k) is a much better alternative for that objective since it doesn't bring the high costs and costs of an IUL policy, plus there is no cap on the quantity you might make when invested. Most IUL policies are best for high-net-worth people looking for to reduce their gross income. Investopedia does not give tax obligation, investment, or financial solutions and advice.

An independent insurance policy broker can compare all the alternatives and do what's best for you. When contrasting IUL quotes from different insurer, it can be complicated and hard to comprehend which option is best. An independent economic professional can discuss the different attributes and recommend the finest choice for your one-of-a-kind circumstance.

What Is The Difference Between Term And Universal Life Insurance

Rather of investigating all the various choices, calling insurance policy business, and asking for quotes, they do all the job for you. Many insurance coverage representatives are able to save their customers cash because they recognize all the ins and outs of Indexed Universal Life strategies.

It's a trustworthy organization that was developed in 1857 HQ is located in Milwaukee, offering for years in monetary services Among the largest insurer, with around 7.5% of the market share Has actually been offering its insurance holders for over 150 years. The firm provides 2 kinds of offers that are term and irreversible life policies.

For bikers, the firm additionally supplies to round out their protection. For them, term life plans include persistent ailments, sped up survivor benefit, and ensured reimbursement options. If you want, you can add an insured term biker and a kid depending on the rider to cover the entire family. For a Common of Omaha life-indexed insurance plan, you require to have a quote or connect with a qualified representative.

Established in 1847, the business makes many lists of the top-rated life insurance policy companies. Penn Mutual offers life insurance policy policies with numerous advantages that suit individuals's demands, like individuals's investment goals, financial markets, and spending plans. Another company that is renowned for providing index universal life insurance plans is Nationwide. Nationwide was founded in 1925.

Best Iul Life Insurance Companies

The head office of the firm lies in Columbus, Ohio. The firm's insurance plan's toughness is 10 to thirty years, together with the provided coverage to age 95. Term plans of the companies can be converted right into irreversible plans for age 65 and sustainable. The firm's global life insurance policy policies offer tax-free survivor benefit, tax-deferred revenues, and the versatility to change your costs settlements.

You can also avail of youngsters's term insurance policy protection and lasting care protection. If you are seeking among the leading life insurance policy firms, Pacific Life is a fantastic selection. The firm has frequently been on the top listing of top IUL firms for several years in regards to marketing items because the company developed its extremely initial indexed universal life products.

What's good concerning Lincoln Financial compared to other IUL insurance policy firms is that you can additionally transform term plans to global policies provided your age is not over 70. Principal Economic insurance policy firm supplies services to around 17 countries throughout international markets. The business gives term and universal life insurance coverage plans in all 50 states.

Variable universal life insurance can be thought about for those still looking for a far better alternative. The money value of an Indexed Universal Life policy can be accessed via plan fundings or withdrawals. Withdrawals will decrease the survivor benefit, and car loans will certainly build up rate of interest, which must be repaid to maintain the policy effective.

Eiul Life Insurance

This plan style is for the consumer that requires life insurance however wish to have the ability to pick how their cash worth is invested. Variable plans are underwritten by National Life and dispersed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Coverage Firm, One National Life Drive, Montpelier, Vermont 05604.

:max_bytes(150000):strip_icc()/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

The info and summaries contained below are not meant to be complete descriptions of all terms, problems and exclusions applicable to the products and solutions. The specific insurance coverage under any nation Investors insurance item undergoes the terms, conditions and exemptions in the real plans as provided. Products and solutions defined in this website vary from one state to another and not all items, protections or services are available in all states.

This info brochure is not a contract of insurance. The policy discussed in this details sales brochure are secured under the Policy Proprietors' Defense System which is administered by the Singapore Deposit Insurance Firm (SDIC).

For additional information on the kinds of advantages that are covered under the scheme in addition to the limits of insurance coverage, where relevant, please contact us or go to the Life insurance policy Organization, Singapore or SDIC internet sites () or (www.sdic.org.sg). This advertisement has not been examined by the Monetary Authority of Singapore.

Latest Posts

Best Indexed Universal Life

The Cash Value In An Indexed Life Insurance Policy

Whole Life Vs Indexed Universal Life